DXC Technology Reports Third Quarter Fiscal Year 2023 Results – DXC Technology

ASHBURN, VA, February 1, 2023 – Today, DXC Technology (NYSE: DXC) reported results for the third quarter of fiscal year 2023.

Mike Salvino, DXC Chairman, President and Chief Executive Officer commented: “I am very pleased with our strong third quarter results, where our execution drove strong bookings, along with Adjusted EBIT margin, Adjusted EPS, and free cash flow that all exceeded expectations. In addition, we continue to execute on our portfolio shaping initiatives, and intend to use our cash to reduce our debt, strengthen our investment grade profile, and to complete our $1 billion share repurchase program. We have created momentum, and we believe that the business is heading to an inflection at the end of FY23. Getting to this point was no small task, and my management team and I are proud of the quality company we have created, and we are clear and excited about delivering the business we envisioned in FY24.”

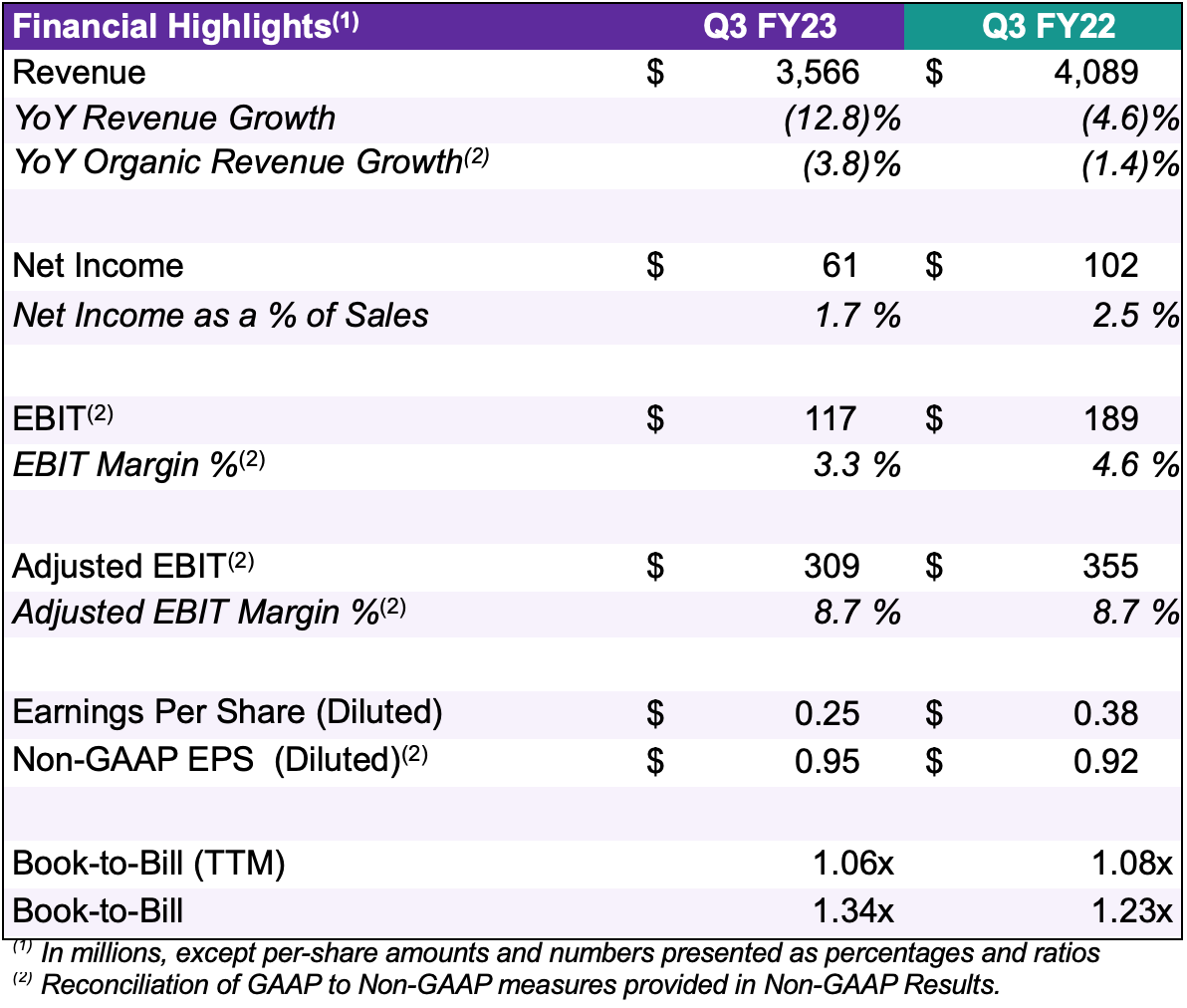

Financial Highlights – Third Quarter of Fiscal Year 2023

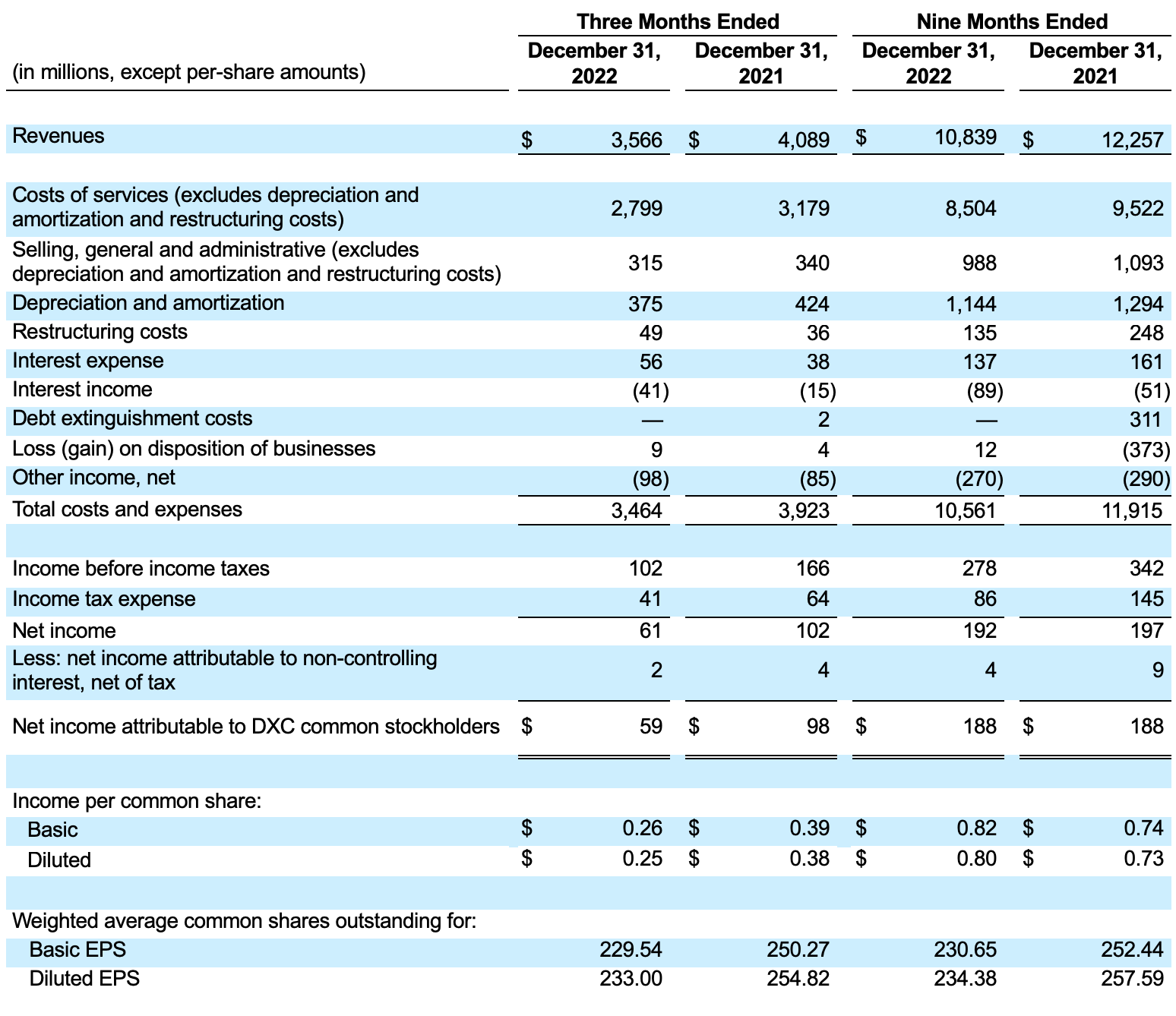

Revenue was $3.57 billion for the third quarter of fiscal year 2023, down 12.8% as compared to prior year period, and down 3.8% on an organic basis. The third quarter of fiscal 2023 was impacted by a difficult comparison related to lower resale, a perpetual license sale in the prior year quarter, and lower than anticipated levels of project revenue this year.

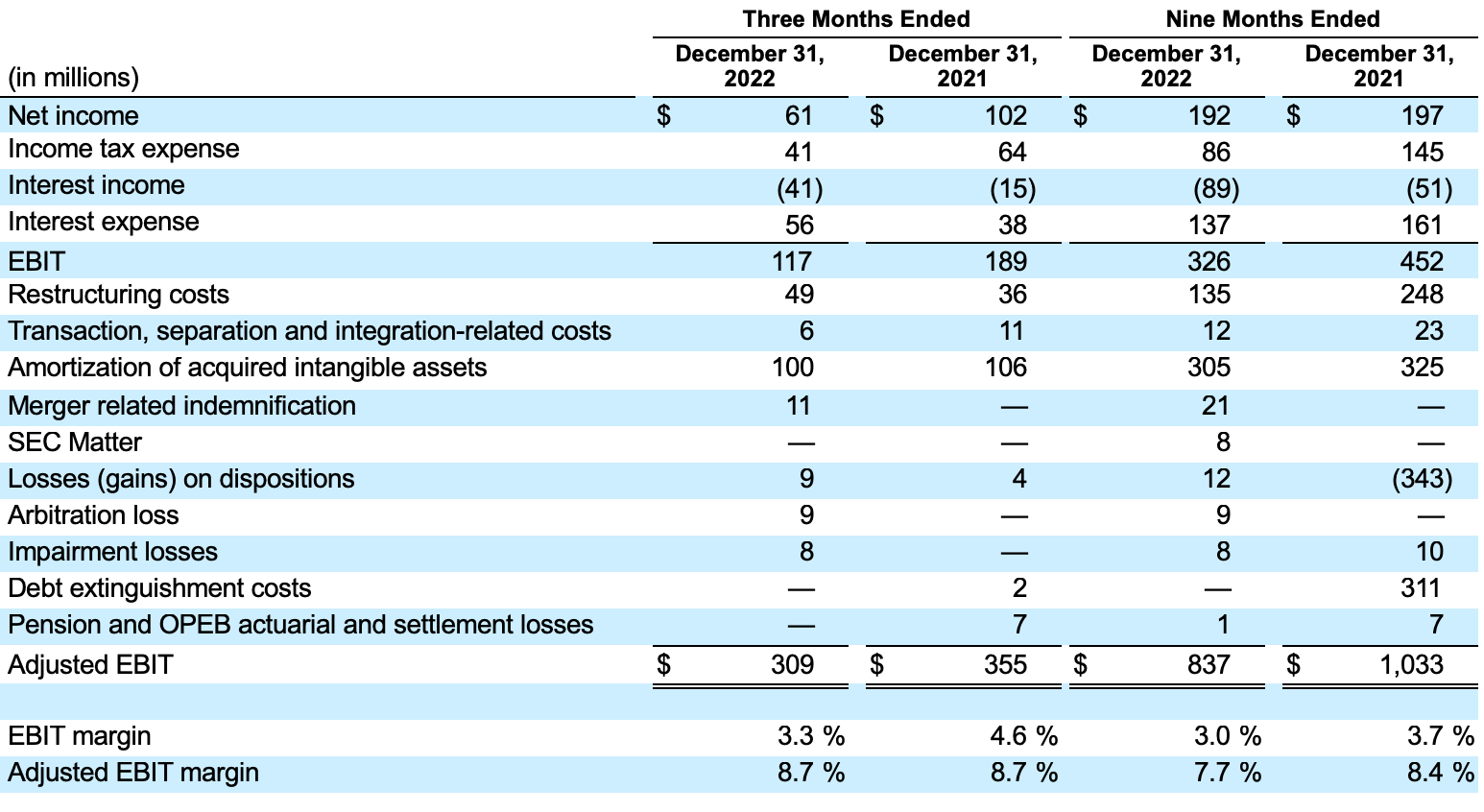

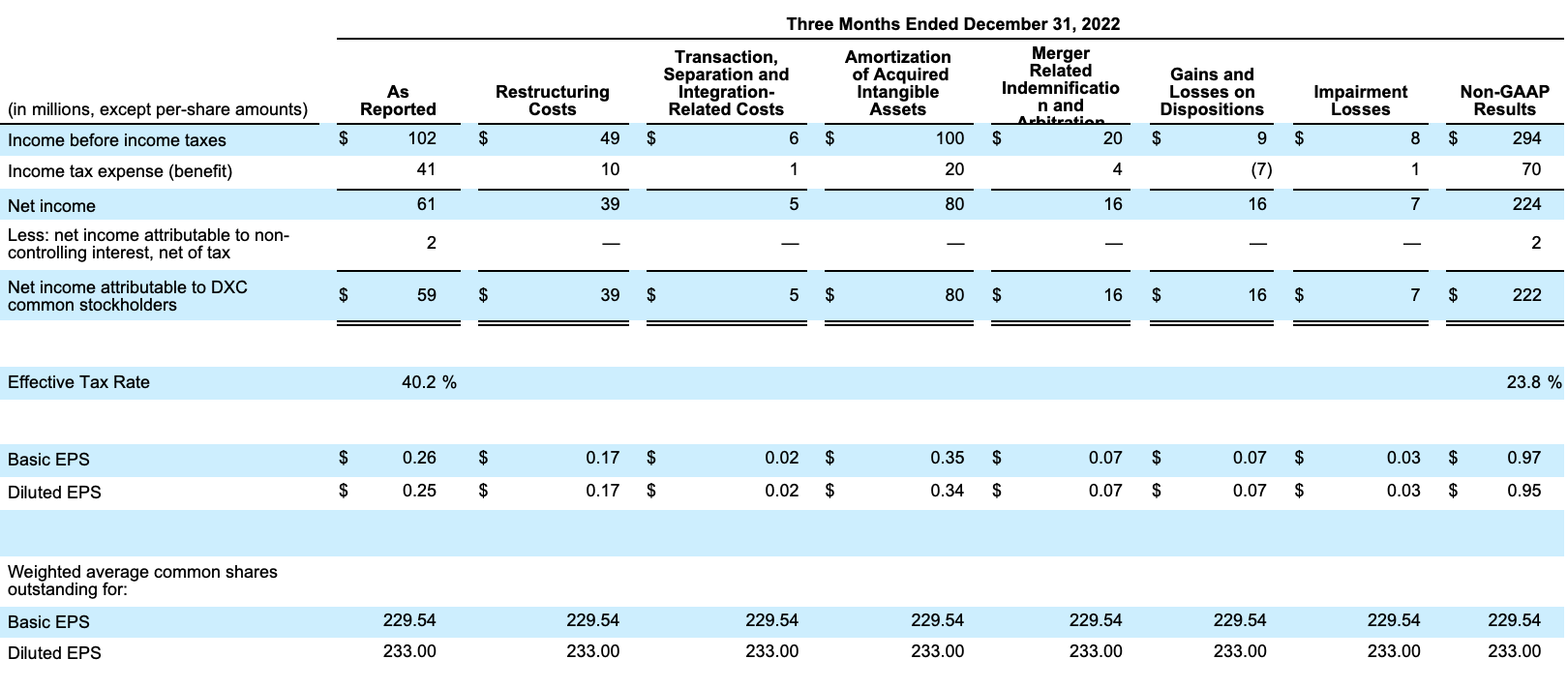

Net income was $61 million, or 1.7% of sales for the third quarter of fiscal year 2023, compared to $102 million, or 2.5% of sales, in the prior year quarter. EBIT was $117 million or 3.3% of sales. Net income and EBIT in the quarter included the following items: amortization of acquired intangible assets of $100 million, restructuring costs of $49 million, merger related indemnification and arbitration charges of $20 million, a loss on disposition of $9 million, an impairment charge of $8 million, and transaction, separation, and integration costs of $6 million. Excluding these items, Adjusted EBIT margin was 8.7% in the third quarter, flat as compared to the prior year quarter.

Diluted earnings per share was $0.25 and Non-GAAP diluted earnings per share was $0.95 for the third quarter of fiscal year 2023. Compared to the prior year quarter, diluted earnings per share and non-GAAP diluted earnings per share were positively impacted by a lower share count and lower net interest expense, partially offset by foreign exchange headwinds and lower sales volumes.

On a trailing twelve months basis, the company delivered a book to bill of 1.06x.

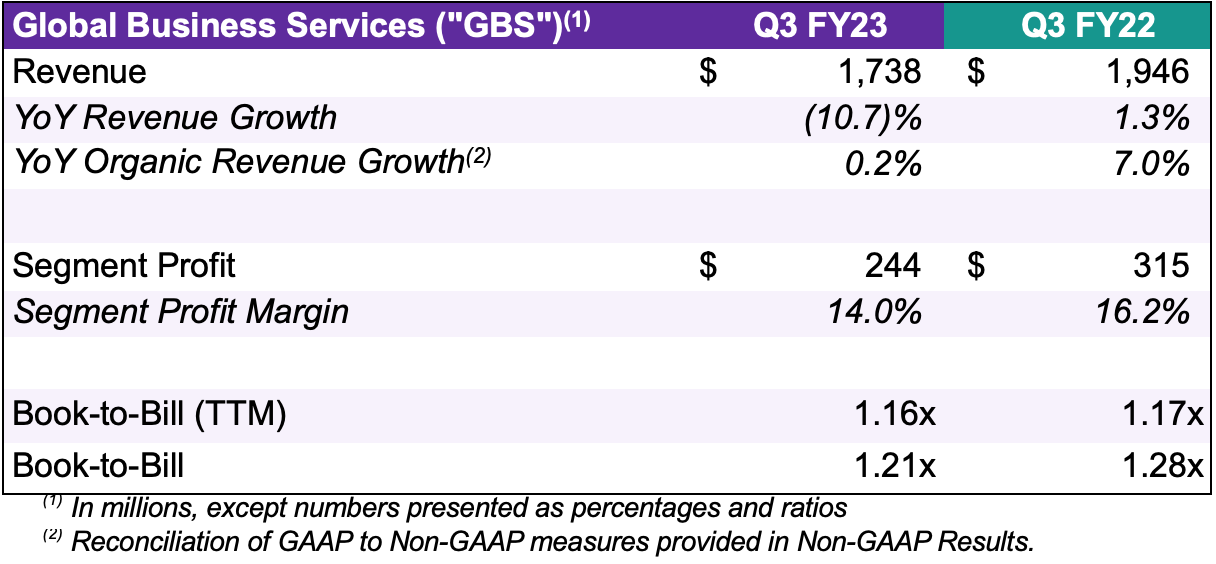

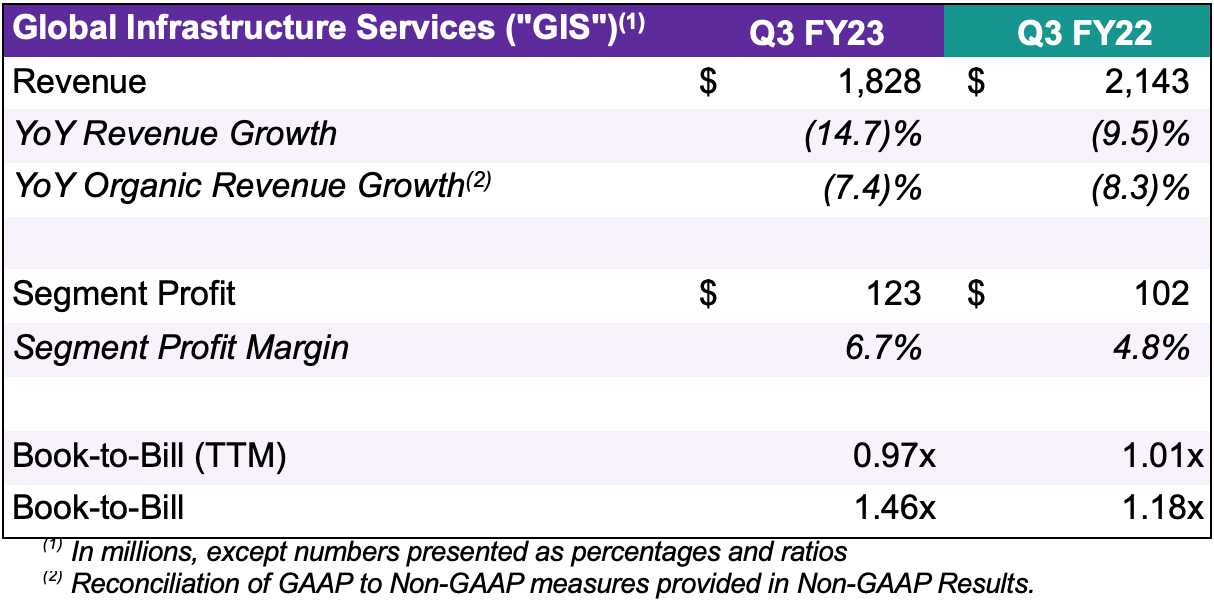

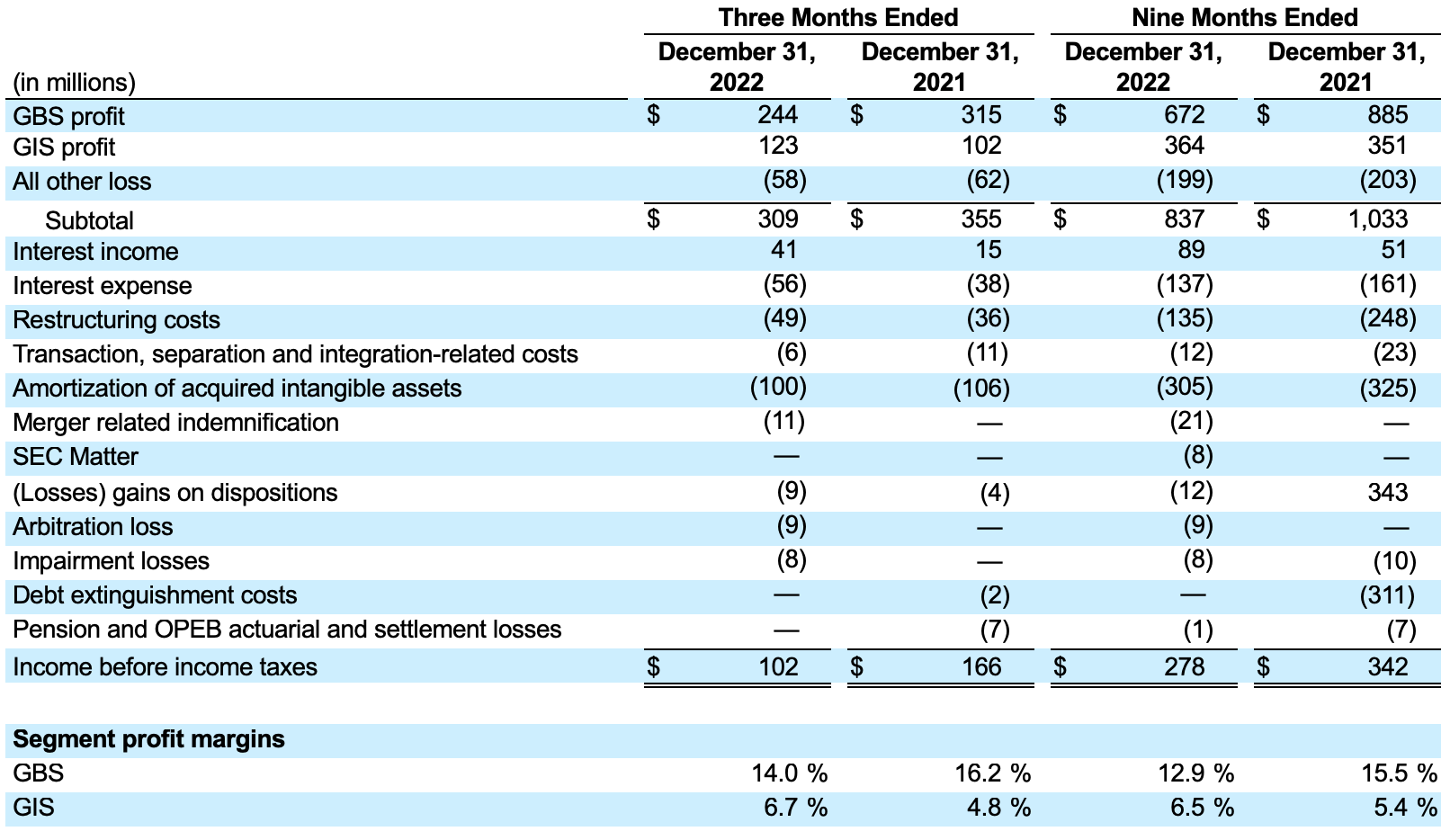

Financial Information by Segment

GBS segment revenue was $1,738 million in the third quarter of fiscal year 2023, down 10.7% compared to the prior year period and up 0.2% on an organic basis. GBS performance was driven by continued growth in the Analytics & Engineering business, where revenue increased 11.7% on an organic basis. GBS segment profit was $244 million and segment profit margin was 14.0%, down 220 bps compared to prior year period, due to a difficult comparison resulting from a perpetual license sale in the prior year quarter. GBS bookings for the quarter were $2.1 billion for a book-to-bill of 1.21x, and 1.16x on a trailing twelve months basis.

GIS segment revenue was $1,828 million in the third quarter of fiscal year 2023, down 14.7% compared to the prior year period, and down 7.4% on an organic basis. GIS segment revenue performance was driven by lower Modern Workplace and Cloud Infrastructure & ITO revenues. GIS segment profit was $123 million with a segment profit margin of 6.7%, a 190 bps margin expansion as compared to third quarter of fiscal year 2022, as a result of our cost optimization program, asset sales, and a favorable commercial settlement. GIS bookings were $2.7 billion in the quarter for a book-to-bill of 1.46x, and 0.97x on a trailing twelve months basis.

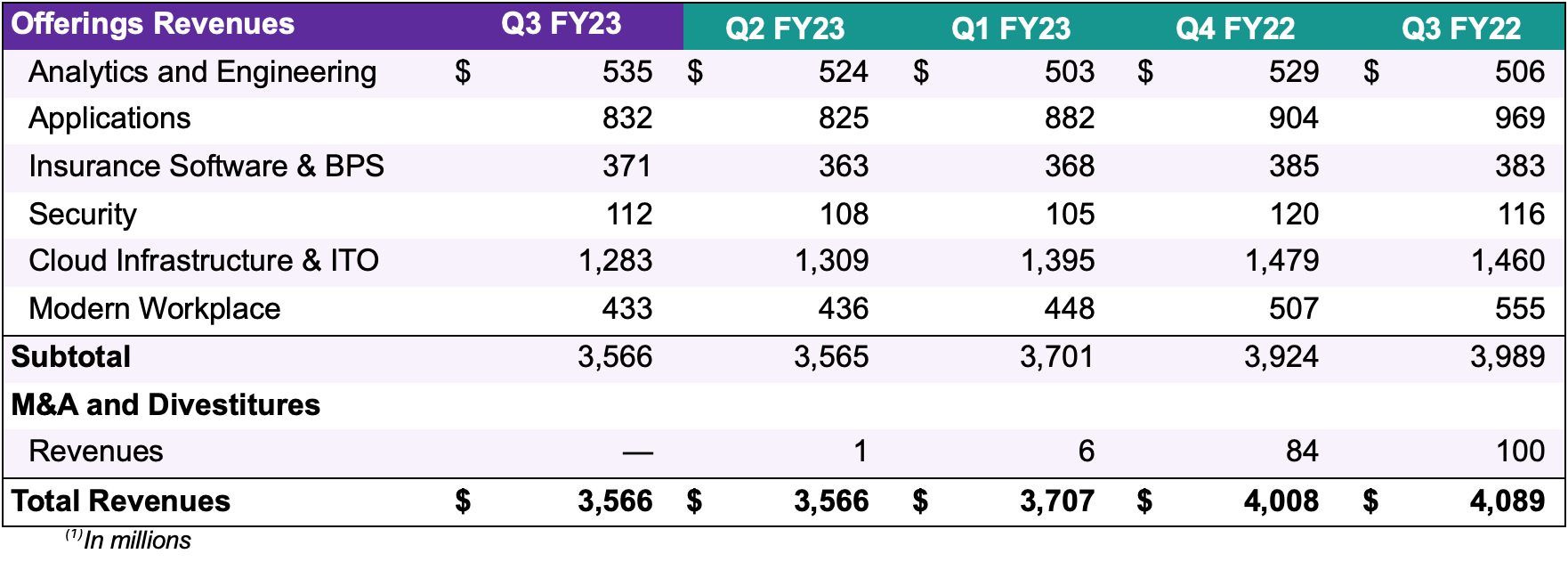

Offering Highlights

The results for our six offerings are as follows:

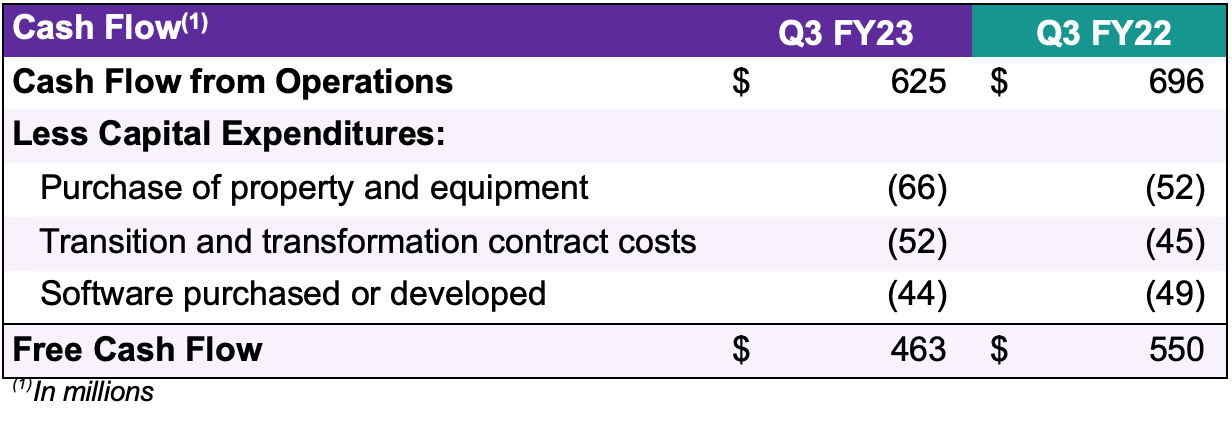

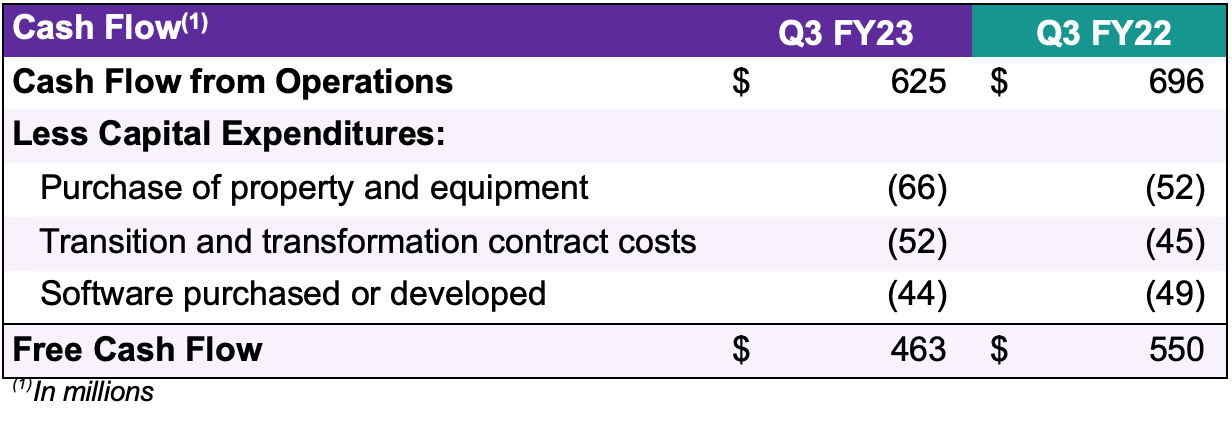

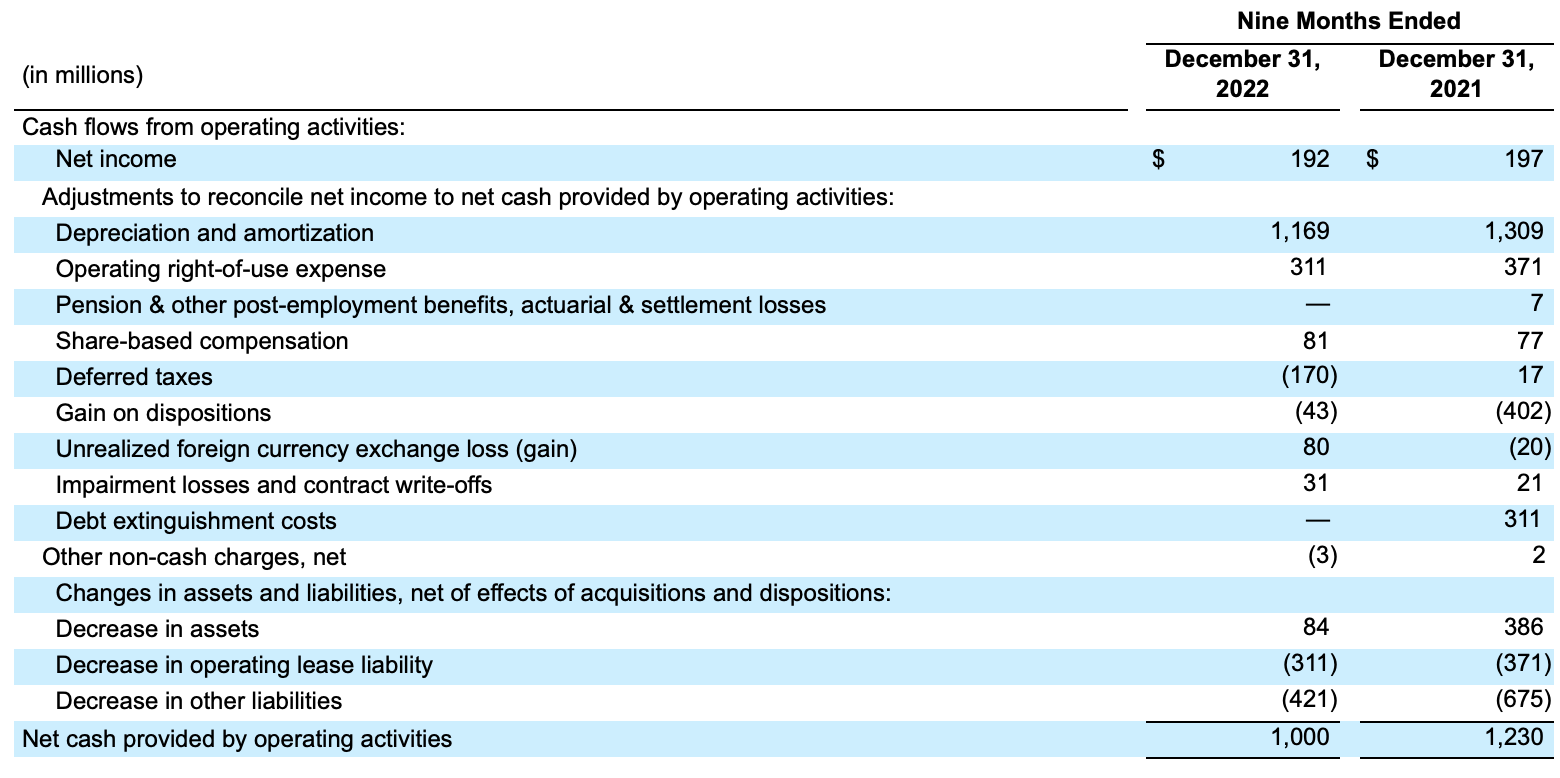

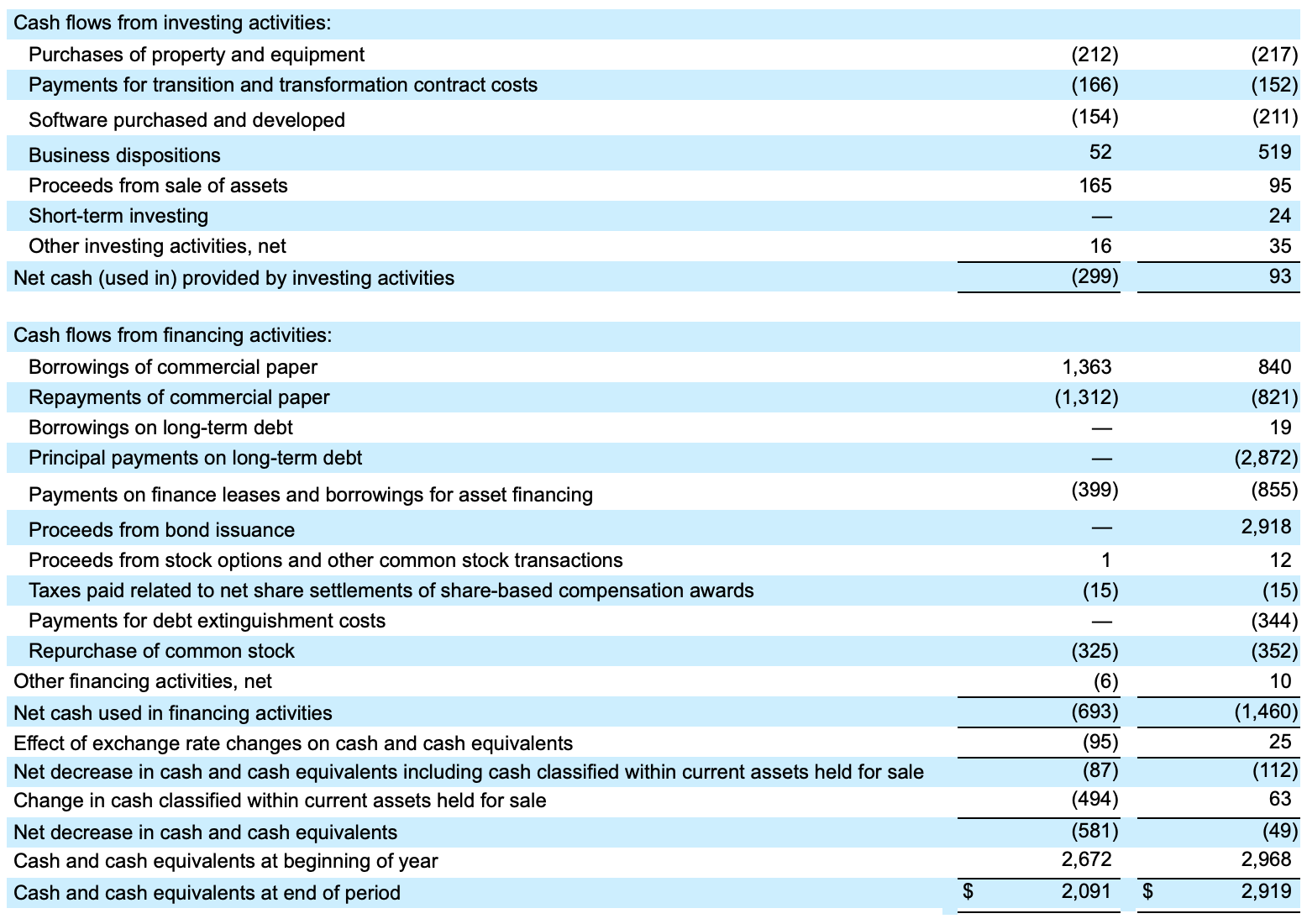

Cash Flow

Cash flow from operations was $625 million in the third quarter of fiscal year 2023, as compared to $696 million in the third quarter of fiscal year 2022, and capital expenditures were $162 million in the third quarter of fiscal year 2023, as compared to $146 million in the third quarter of fiscal year 2022. Free cash flow (cash flow from operations, less capital expenditures) was $463 million in the third quarter of fiscal year 2023, as compared to $550 million in the third quarter of fiscal year 2022. On a year to date basis, operating cash flow and free cash flow were impacted by lower deposits at the German Banks of approximately $70 million.

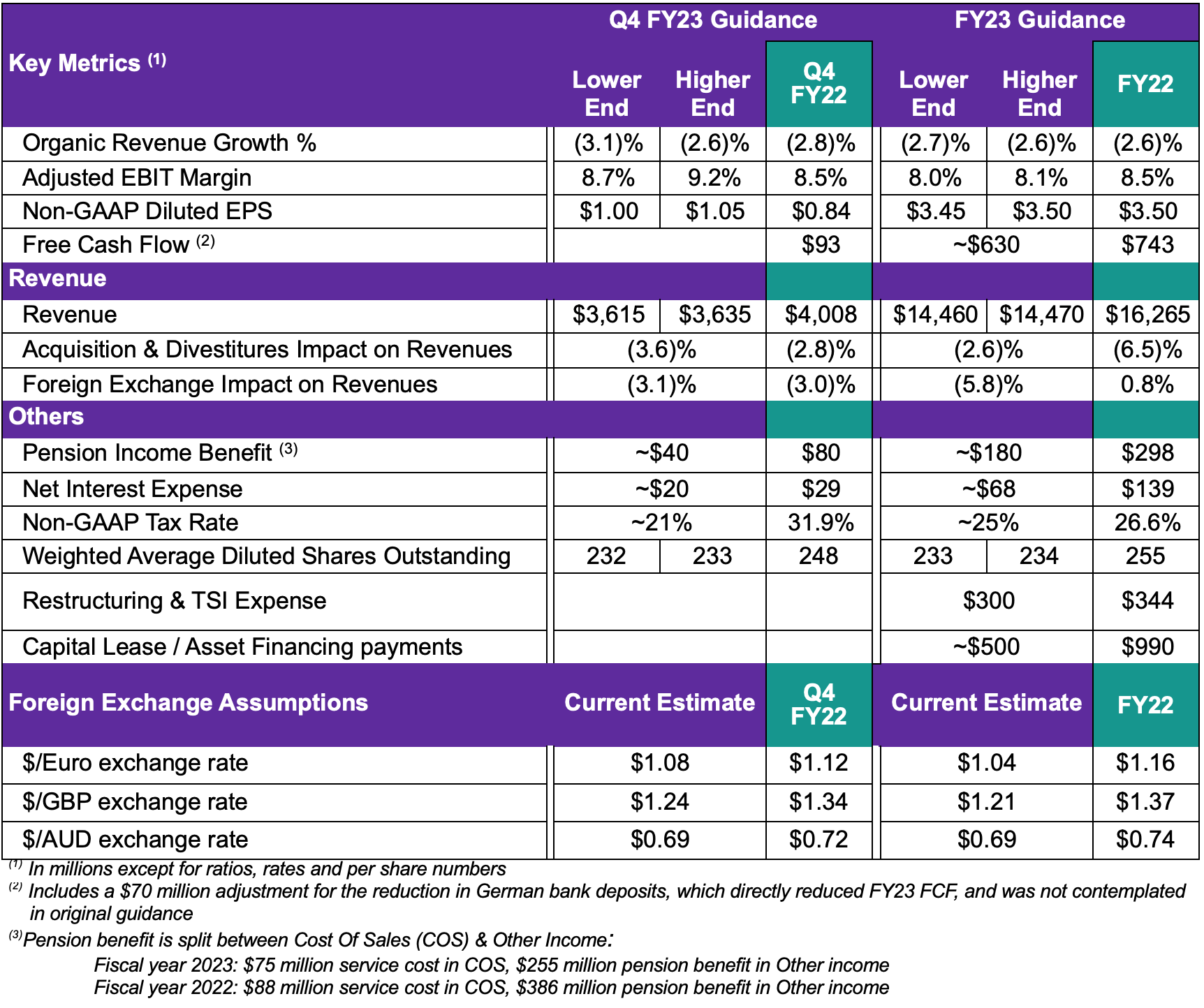

Guidance

The Company’s guidance for the fourth quarter and full fiscal year 2023 is as follows:

The Company’s preliminary fiscal year 2024 expectation is:

- Organic revenue growth of flat to 1%

- Adjusted EBIT margin above FY23 levels but do not expect the margin to exceed 9.0%

- Free cash flow above FY23 levels, but do not expect to exceed $900 million

- Restructuring and TSI expense of ~$100 million

DXC does not provide a reconciliation of Non-GAAP measures that it discusses as part of its guidance because certain significant information required for such reconciliation is not available without unreasonable efforts or at all, including, most notably, the impact of significant non-recurring items. Without this information, DXC does not believe that a reconciliation would be meaningful.

Earnings Conference Call and Webcast

DXC Technology senior management will host a conference call and webcast to discuss these results on February 1, 2023, at 5:00 p.m. EDT. The dial-in number for domestic callers is +1 (888) 330-2455. Callers who reside outside of the United States should dial +1 (240) 789-2717. The passcode for all participants is 4164760. The webcast audio and any presentation slides will be available on DXC Technology’s Investor Relations website.

A replay of the conference call will be available from approximately two hours after the conclusion of the call until February 8, 2023. The phone number for the replay is +1 (800) 770-2030 or +1 (647) 362-9199. The replay passcode is 4164760.

About DXC Technology

DXC Technology (NYSE: DXC) helps global companies run their mission-critical systems and operations while modernizing IT, optimizing data architectures, and ensuring security and scalability across public, private, and hybrid clouds. The world’s largest companies and public sector organizations trust DXC to deploy services to drive new levels of performance, competitiveness, and customer experience across their IT estates. Learn more about how we deliver excellence for our customers and colleagues at DXC.com.

Forward-Looking Statements

All statements and assumptions contained in this press release that do not directly and exclusively relate to historical facts constitute “forward-looking statements.” Forward-looking statements often include words such as “anticipates,” “believes,” “estimates,” “expects,” “forecast,” “goal,” “intends,” “objective,” “plans,” “projects,” “strategy,” “target,” and “will” and words and terms of similar substance in discussions of future operating or financial performance. These statements represent current expectations and beliefs, and no assurance can be given that the results described in such statements will be achieved.

Forward-looking statements include, among other things, statements with respect to our future financial condition, results of operations, cash flows, business strategies, operating efficiencies or synergies, divestitures, competitive position, growth opportunities, share repurchases, dividend payments, plans and objectives of management and other matters. Such statements are subject to numerous assumptions, risks, uncertainties and other factors that could cause actual results to differ materially from those described in such statements, many of which are outside of our control. Furthermore, many of these risks and uncertainties are currently amplified by and may continue to be amplified by or may, in the future, be amplified by the coronavirus disease 2019 (“COVID-19”) crisis and the impact of varying private and governmental responses that affect our customers, employees, vendors and the economies and communities where they operate.

Important factors that could cause actual results to differ materially from those described in forward-looking statements include, but are not limited to:

- the uncertainty of the magnitude, duration, geographic reach of the COVID-19 crisis, its impact on the global economy and the impact of current and potential travel restrictions, stay-at-home orders, vaccine mandates and economic restrictions implemented to address the crisis;

- our inability to succeed in our strategic objectives;

- the risk of liability or damage to our reputation resulting from security incidents, including breaches, and cyber-attacks to our systems and networks and those of our business partners, insider threats, disclosure of sensitive data or failure to comply with data protection laws and regulations in a rapidly evolving regulatory environment; in each case, whether deliberate or accidental;

- our inability to develop and expand our service offerings to address emerging business demands and technological trends, including our inability to sell differentiated services amongst our offerings;

- our inability to compete in certain markets and expand our capacity in certain offshore locations and risks associated with such offshore locations such as Russia’s recent invasion of Ukraine;

- failure to maintain our credit rating and ability to manage working capital, refinance and raise additional capital for future needs;

- our indebtedness;

- the competitive pressures faced by our business;

- our inability to accurately estimate the cost of services, and the completion timeline of contracts;

- execution risks by us and our suppliers, customers, and partners;

- the risks associated with natural disasters;

- our inability to retain and hire key personnel and maintain relationships with key partners;

- the risks associated with prolonged periods of inflation or current macroeconomic conditions, including the current decline in economic growth rates in the United States and in other countries, including the possibility of reduced spending by customers in the areas we serve, the success of our cost-takeout efforts, continuing unfavorable foreign exchange rate movements, and our ability to close new deals in the event of an economic slowdown;

- the risks associated with our international operations, such as risks related to currency exchange rates and the withdrawal of U.K. from the European Union on January 31, 2020;

- our inability to comply with governmental regulations or the adoption of new laws or regulations, including social and environmental responsibility regulations, policies and provisions;

- our inability to achieve the expected benefits of our restructuring plans;

- inadvertent infringement of third-party intellectual property rights or our inability to protect our own intellectual property assets;

- our inability to procure third-party licenses required for the operation of our products and service offerings;

- risks associated with disruption of our supply chain;

- our inability to maintain effective internal control over financial reporting;

- potential losses due to asset impairment charges;

- our inability to pay dividends or repurchase shares of our common stock;

- pending investigations, claims and disputes and any adverse impact on our profitability and liquidity;

- disruptions in the credit markets, including disruptions that reduce our customers’ access to credit and increase the costs to our customers of obtaining credit;

- our failure to bid on projects effectively;

- financial difficulties of our customers and our inability to collect receivables;

- our inability to maintain and grow our customer relationships over time and to comply with customer contracts or government contracting regulations or requirements;

- our inability to succeed in our strategic transactions;

- changes in tax laws and any adverse impact on our effective tax rate;

- risks following the merger of Computer Sciences Corporation (“CSC”) and Enterprise Services business of Hewlett Packard Enterprise Company’s (“HPES”) businesses, including anticipated tax treatment, unforeseen liabilities, and future capital expenditures;

- risks following the spin-off of our former U.S. Public Sector business (the “USPS”) and its related mergers with Vencore Holding Corp. and KeyPoint Government Solutions in June 2018 to form Perspecta Inc. (including its successors and permitted assigns, “Perspecta”), which was acquired by Peraton in May 2021; and

- the other factors described in Part I, Item 1A “Risk Factors” of our Annual Report on Form 10-K for the fiscal year ended March 31, 2022 and subsequent SEC filings, including Part II Item 1A “Risk Factors” of our Quarterly Report on Form 10-Q.

No assurance can be given that any goal or plan set forth in any forward-looking statement can or will be achieved, and readers are cautioned not to place undue reliance on such statements, which speak only as of the date they are made. We do not undertake any obligation to update or release any revisions to any forward-looking statement or to report any events or circumstances after the date of this press release or to reflect the occurrence of unanticipated events, except as required by law.

About Non-GAAP Measures

In an effort to provide investors with supplemental financial information, in addition to the preliminary and unaudited financial information presented on a GAAP basis, we have also disclosed in this press release preliminary Non-GAAP information including: earnings before interest and taxes (“EBIT”), EBIT margin, Adjusted EBIT, Adjusted EBIT margin, Non-GAAP diluted EPS, organic revenue growth, and free cash flow.

We believe EBIT, EBIT margin, Adjusted EBIT, Adjusted EBIT margin, and Non-GAAP diluted EPS provide investors with useful supplemental information about our operating performance after excluding certain categories of expenses. Free cash flow represents cash flow from operations, less capital expenditures.

One category of expenses excluded from Adjusted EBIT, Adjusted EBIT margin, and Non-GAAP diluted EPS, incremental amortization of intangible assets acquired through business combinations, may result in a significant difference in period over period amortization expense on a GAAP basis. We exclude amortization of certain acquired intangible assets as these non-cash amounts are inconsistent in amount and frequency and are significantly impacted by the timing and/or size of acquisitions. Although DXC management excludes amortization of acquired intangible assets primarily customer-related intangible assets, from its Non-GAAP expenses, we believe that it is important for investors to understand that such intangible assets were recorded as part of purchase accounting and support revenue generation. Any future transactions may result in a change to the acquired intangible asset balances and associated amortization expense.

Another category of expenses excluded from Adjusted EBIT, Adjusted EBIT margin, and Non-GAAP diluted EPS, impairment losses, may result in a significant difference in period over period expense on a GAAP basis. We exclude impairment losses as these non-cash amounts, reflect generally an acceleration of what would be multiple periods of expense and do not expect to occur frequently. Further assets such as goodwill may be significantly impacted by market conditions outside of management’s control.

We believe organic revenue growth provides investors with useful supplemental information about our revenues after excluding the effect of currency exchange rate fluctuations for currencies other than U.S. dollars and the effects of acquisitions and divestitures in the periods presented. See below for a description of the methodology we use to present organic revenues.

Selected references are made to revenue growth on an “organic basis” so that certain financial results can be viewed without the impact of fluctuations in foreign currency rates and without the impacts of acquisitions and divestitures from “organic basis” financial results, thereby providing comparisons of operating performance from period to period of the business that we have owned during all periods presented. Organic revenue growth is calculated by dividing the year-over-year change in GAAP revenues attributed to organic growth by the GAAP revenues reported in the prior comparable period. This approach is used for all results where the functional currency is not the U.S. dollar.

There are limitations to the use of the Non-GAAP financial measures presented in this press release. One of the limitations is that they do not reflect complete financial results. We compensate for this limitation by providing a reconciliation between our Non-GAAP financial measures and the respective most directly comparable financial measure calculated and presented in accordance with GAAP. Additionally, other companies, including companies in our industry, may calculate Non-GAAP financial measures differently than we do, limiting the usefulness of those measures for comparative purposes between companies.

Condensed Consolidated Statements of Operations

(preliminary and unaudited)

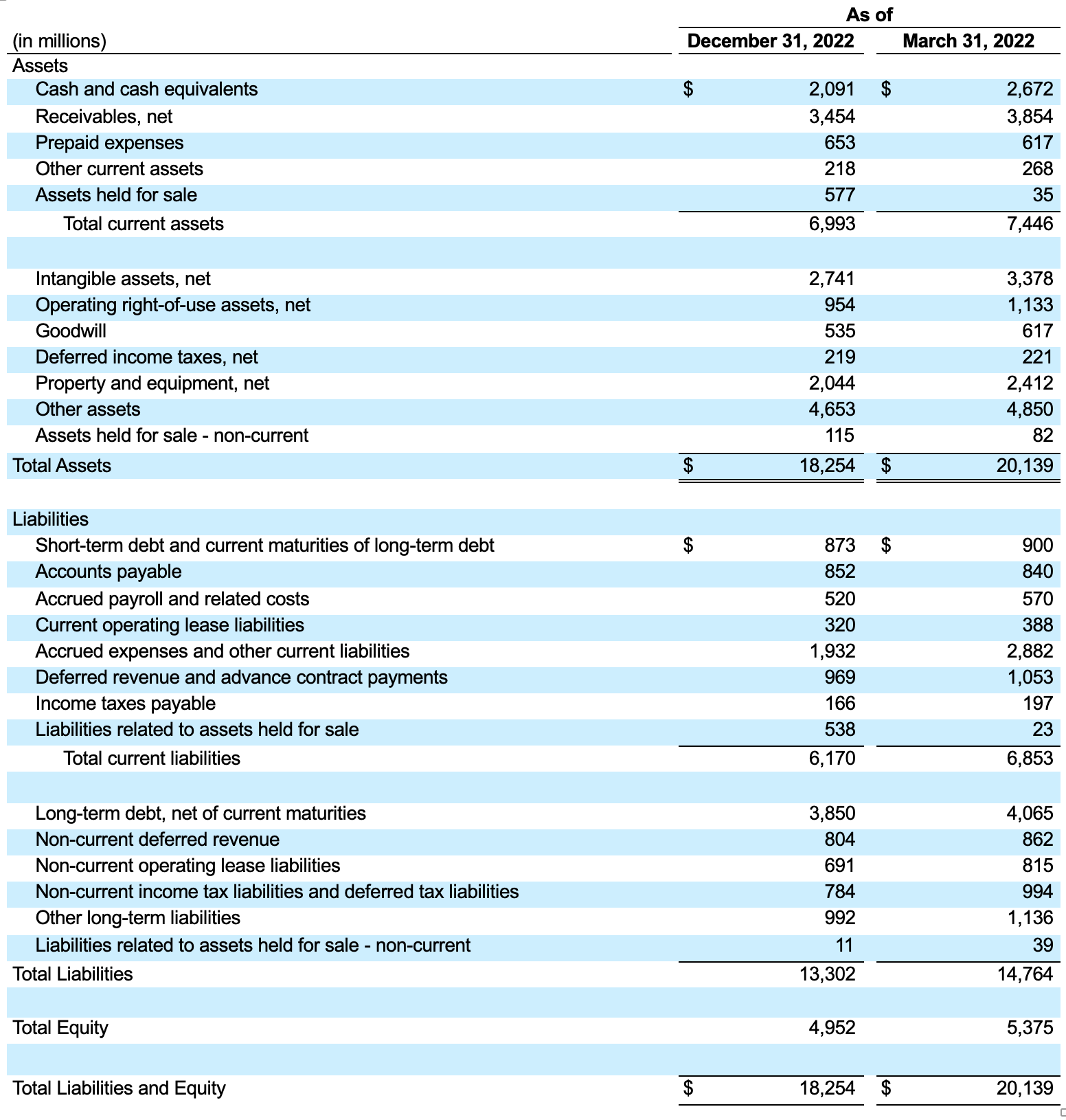

Selected Condensed Consolidated Balance Sheet Data

(preliminary and unaudited)

Condensed Consolidated Statements of Cash Flows

(preliminary and unaudited)

Segment Profit

We define segment profit as segment revenues less costs of services, segment selling, general and administrative, depreciation and amortization, and other income (excluding the movement in foreign currency exchange rates on our foreign currency denominated assets and liabilities and the related economic hedges). The Company does not allocate to its segments certain operating expenses managed at the corporate level. These unallocated costs generally include certain corporate function costs, stock-based compensation expense, pension and other post-retirement benefits (“OPEB”) actuarial and settlement gains and losses, restructuring costs, transaction, separation and integration-related costs, and amortization of acquired intangible assets.

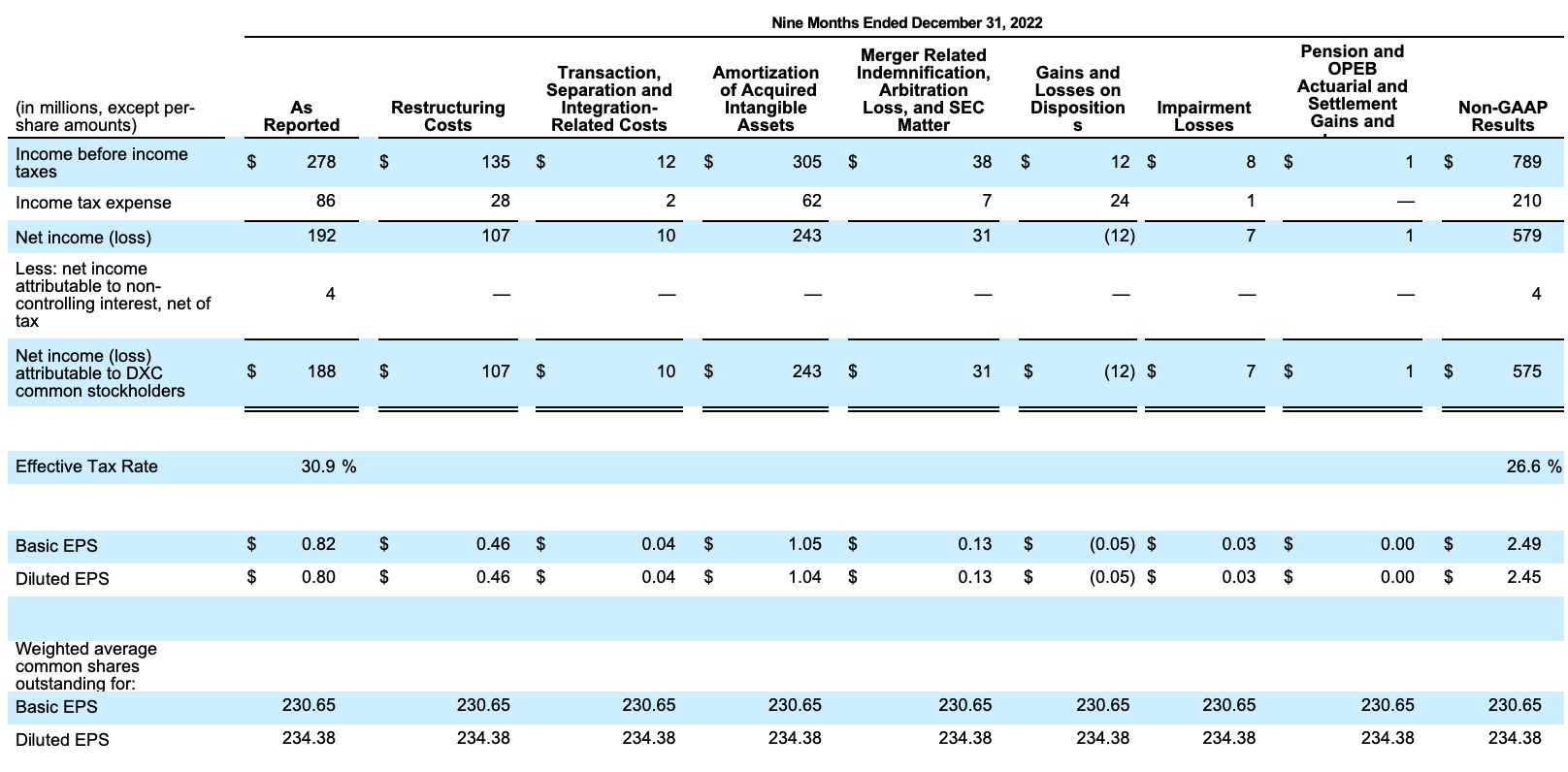

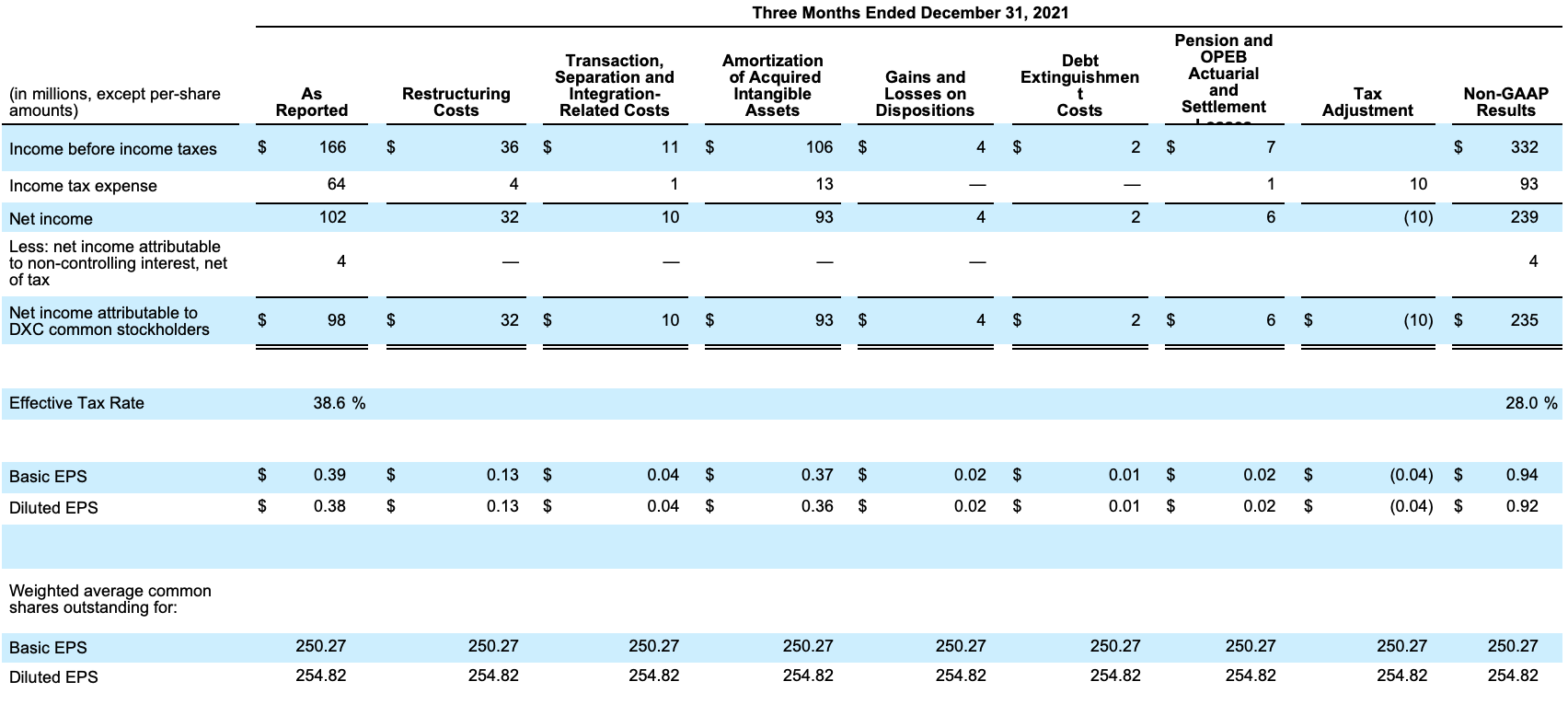

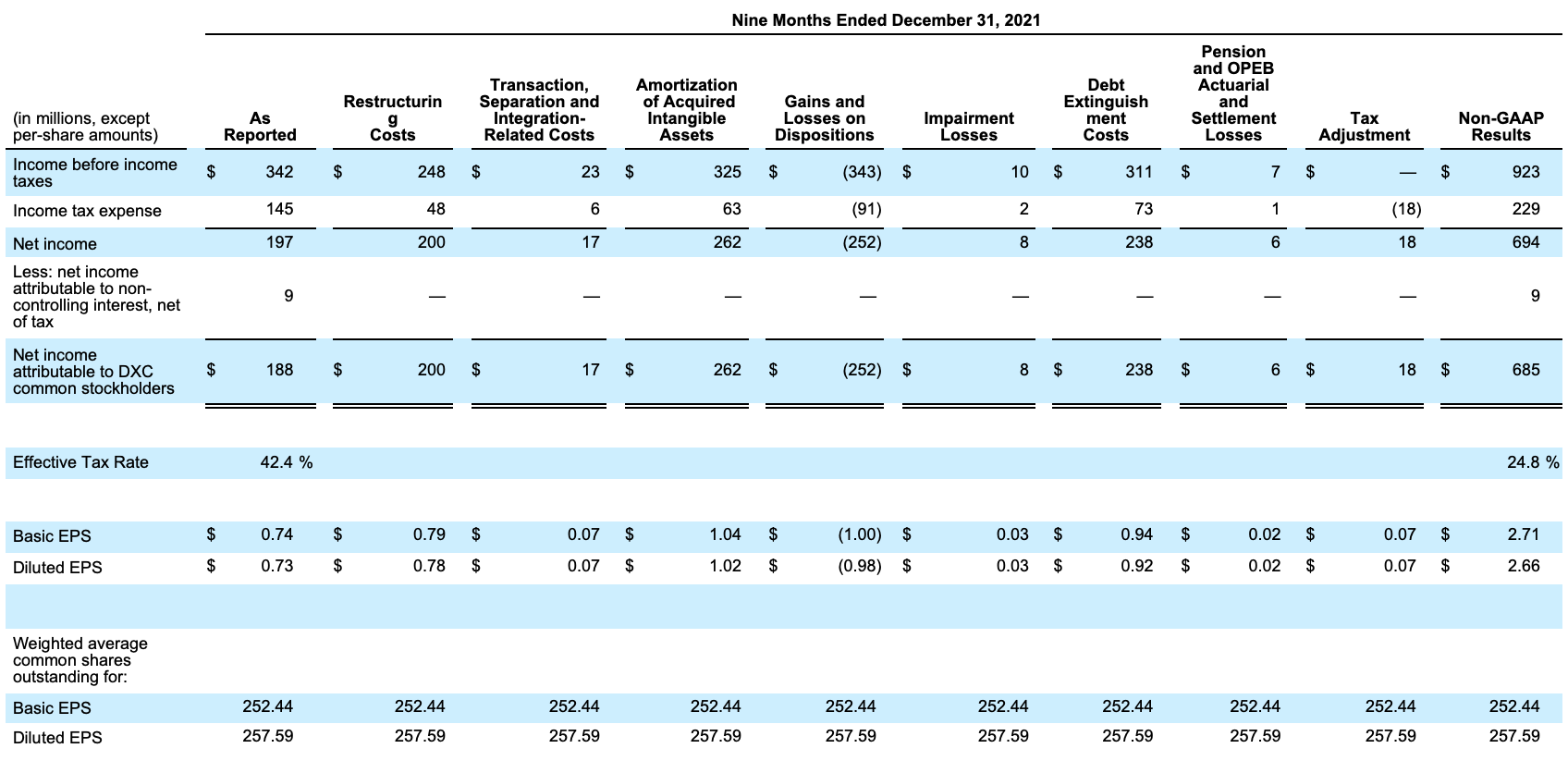

Reconciliation of Non-GAAP Financial Measures

Our Non-GAAP adjustments include:

- Restructuring costs – includes costs, net of reversals, related to workforce and real estate optimization and other similar charges.

- Transaction, separation and integration-related (“TSI”) costs – includes costs related to integration, planning, financing and advisory fees and other similar charges associated with mergers, acquisitions, strategic investments, joint ventures, and dispositions and other similar transactions.(1)

- Amortization of acquired intangible assets – includes amortization of intangible assets acquired through business combinations.

- Pension and OPEB actuarial and settlement gains and losses – pension and OPEB actuarial mark to market adjustments and settlement gains and losses.

- Merger related indemnification – represents the Company’s current estimate of potential liability to HPE for indemnification on the Forsyth v. HP Inc. and HPE litigation, and the Company’s final liability to HPE on the Oracle v. HPE litigation; both obligations pursuant to HPES merger.(2)

- SEC Matter – represents the Company’s current estimate of potential liability related to a previously disclosed investigation into its historical determination and disclosure of certain “transaction, separation, and integration-related costs” as part of the Company’s non-GAAP adjustments.(3)

- Gains and losses on dispositions – gains and losses related to dispositions of businesses, strategic assets and interests in less than wholly-owned entities.(4)

- Arbitration loss – reflects a loss arising from an arbitration decision in the third quarter of fiscal 2023.

- Impairment losses – impairment losses on assets classified as long-term on the balance sheet.(5)

- Debt extinguishment costs – costs associated with early retirement, redemption, repayment or repurchase of debt and debt-like items including any breakage, make-whole premium, prepayment penalty or similar costs as well as solicitation and other legal and advisory expenses.(6)

- Tax adjustments – discrete tax adjustments to impair or recognize certain deferred tax assets, adjustments for changes in tax legislation and the impact of merger and divestitures. Income tax expense of all other (non-discrete) non-GAAP adjustments is based on the difference in the GAAP annual effective tax rate (AETR) and overall non-GAAP provision (consistent with the GAAP methodology).(7)

(1) TSI-Related costs include fees and other internal and external expenses associated with legal, accounting, consulting, due diligence, investment banking advisory, and other services, as well as financing fees, retention incentives, and resolution of transaction related claims in connection with, or resulting from, exploring or executing potential acquisitions, dispositions and strategic investments, whether or not announced or consummated.

The TSI-Related costs for the third quarter of fiscal 2023 include $6 million of costs incurred in connection with activities related to acquisitions and divestitures.

The TSI-Related costs for the first nine months of fiscal 2023 include $12 million of costs incurred in connection with activities related to acquisitions and divestitures.

The TSI-Related costs for the third quarter of fiscal 2022 include $10 million of costs incurred in connection with activities related to acquisitions and divestitures; and $1 million of expenses related to integration projects from the HPES merger.

The TSI-Related costs for the first nine months of fiscal 2022 include $13 million of costs to execute the strategic alternatives; $4 million of legal costs; a $14 million credit towards the Peraton Arbitration settlement; $5 million in expenses related to integration projects resulting from the HPES merger (including costs associated with continuing efforts to separate certain IT systems); and $15 million of costs incurred in connection with activities related to other acquisitions and divestitures.

(2) See Note 19 – “Commitments and Contingencies,” Oracle America, Inc., et al. v. Hewlett Packard Enterprise Company; and Forsyth, et al. v. HP Inc. and Hewlett Packard Enterprise.

(3) See Note 19 – “Commitments and Contingencies,” SEC Matter.

(4) Gains and losses on dispositions for the first nine months of fiscal 2023 include a net loss of $12 million on dispositions related to certain insignificant businesses.

Gains and losses on dispositions for the first nine months of fiscal 2022 include a $337 million gain on sale of the HPS business, gains of $19 million on other dispositions partially offset by $13 million of adjustments relating to the sale of the HHS business.

(5) Impairment losses on dispositions for the first nine months of fiscal 2023 include an $8 million impairment charge for customer related intangible assets.

Impairment losses on dispositions for the first nine months of fiscal 2022 include a $10 million impairment charge of undeployed assets related to TSI-related capitalized costs.

(6) Debt extinguishment costs were $2 million and $311 million for the third quarter and first nine months of fiscal 2022, respectively, for the partial and full redemption of term loans, senior notes, and extinguishment of debt associated with asset financing.

(7)Tax adjustment for the first nine months of fiscal 2022 reflects net revaluation of deferred taxes resulting from changes in non-US jurisdiction tax rates.

Non-GAAP Results

A reconciliation of reported results to Non-GAAP results is as follows:

The above tables serve to reconcile the Non-GAAP financial measures to the most directly comparable GAAP measures. Please refer to the “About Non-GAAP Measures” section of the press release for further information on the use of these Non-GAAP measures.

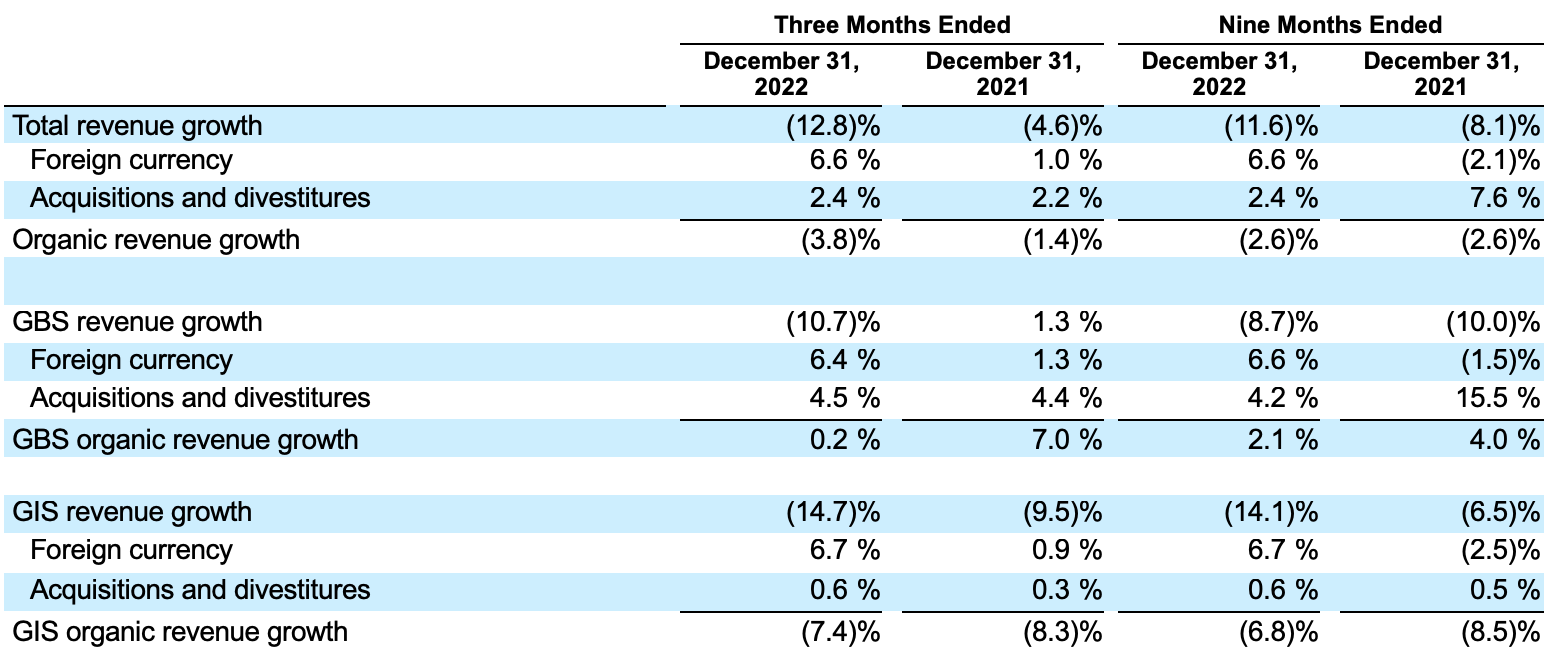

Year-over-Year Organic Revenue Growth